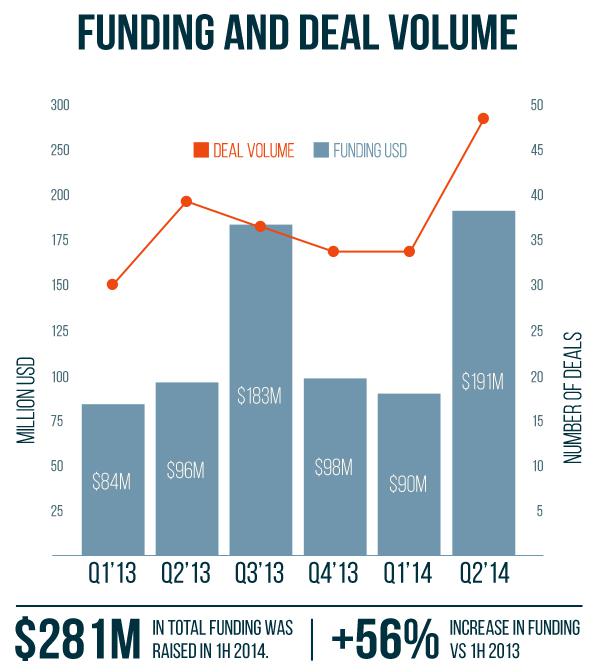

We took a look at Colorado’s top five venture capital investment firms within the last five years based on the number of deals closed in Colorado (with data from Built in Colorado and CB Insights). Here's what you should know about them:

The most active Colorado investors are from…. Colorado

Four of the top five venture capital firms are based in Colorado. Only Vienna, Virginia-based Grotech comes from outside the state. Three out of the five are based in Boulder, reflecting the city’s still enormous influence on the Colorado tech ecosystem.

Venture Capital Firm | Location |

Foundry Group | Boulder, CO |

Access Venture Partners | Westminster, CO |

High Country Ventures | Boulder, CO |

Grotech Ventures | Vienna, VA |

Boulder Ventures | Boulder, CO |

Though Coloradans would likely appreciate more outside attention, they should not be too disappointed by deal-flow dominated by local investors. The relationships that develop between local investors and entrepreneurs are the sorts that pay over-and-over again. Serial entrepreneurs need local partners who know their businesses well, not the kind of opportunistic investor that flies in just when it suits them.

These Colorado investors are investing in Colorado companies

In light of the fact that many of you may be looking for capital, we looked through our database and highlighted some of the local investments made by Colorado’s top five VCs. Based on their past investments these VCs may be great future partners.

Notable Colorado Investments: SendGrid(email service), TechStars(accelerator), Sympoz(online classes), PivotDesk(online office space listing), Integrate(cloud marketing platform), FullContact(contact management software & API) and Gnip(social media API)

Notable Colorado Investments: AlchemyAPI(Big Data), CommercialTribe(sales process instruction platform), Inspirato(private destination club), LogRythm(log & event management), Pawngo(online pawnshop), Rebit(backup software), RoundPegg(HR software), SpotRight(CRM social intelligence), Sympoz(online classes), TapInfluence(marketing platform), Tendril(energy management software), TrackVia(software building wizard for novices)

Notable Colorado Investments: FullContact(contact management software), QualVu(mobile video insights), Birdbox(photo sharing), Collective IP(patent software), Kapost(content marketing software), Digabit(digital document library), Lijit Networks(audience engagement software), Envysion(video-driven business intelligence), LogRythm(log & event management)

Notable Colorado Investments: Cloud Elements(cloud API integration), CommercialTribe(sales process instruction platform), Closely(digital marketing), GutCheck(online market research), TapInfluence(marketing platform), Plink(rewards platform), SpotRight(CRM social intelligence), LogRythm(log & event management), TapInfluence(marketing platform), NexGen Storage(hybrid storage applications)

Notable Colorado Investments: Rally Software(agile application lifecycle management platform), BroadHop(policy control platform), Cadre Technologies(order fulfillment software), CenterStone Technologies(B2B ecommerce), Datavail(database services), Market Force Information(Customer Intelligence)

Enterprise Cloud-Based Software Is the Investment of Choice

Overwhelmingly, local venture capital is investing in enterprise cloud-based software companies. Colorado’s excellence in enterprise software was reflected in our first-half of 2014 funding report, so this should not be a surprise to anyone. In fact, not one of the top five most active VCs missed that category. And several of these VC firms shared investments in companies. For example, LogrRthm was invested in by Access Venture Partners, High Country Ventures, and Grotech Ventures.

The Other Guys Will Come Eventually…

Though most of the country’s deal flow goes to Silicon Valley, expect the success of Colorado-based tech companies to attract attention, then investments. If investors don't yet see reason to invest outside the Bay Area, they will in time. As competition for startup equity heats up, capital will cheapen and venture capital returns will weaken in the Valley. That will eventually be to the benefit of Colorado entrepreneurs, as more investors from outside will come to the state looking for more favorable deals.

In the meantime, with $281 million raised in the first-half of 2014, Colorado looks to be doing all right.