To anyone who lives in Denver or Boulder, it’s clear the cities are on the upswing.

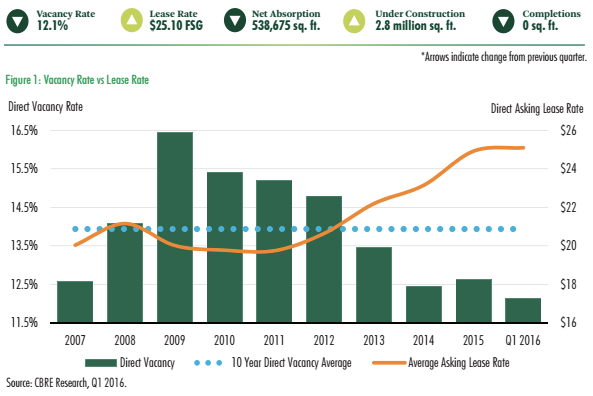

There's no better evidence than the upswing in commercial real estate. CBRE's Office Marketview Report shows the average asking lease rate climbed to a record $25.10 FSG per sq. ft., which is a 6 percent increase from Q1 2015.

Colorado companies are filling up any open office space despite the fact that no new major office building opened its doors this quarter. The reported rate of office vacancy (12.1 percent) is the lowest since 2000 and with a handful of new spaces set to be completed in the next few quarters, there appears to be a new wave of tech companies ready to move in.

Notable tech deals include and 's new offices downtown, at 16th and Arapahoe and 18th and California respectively. is also building out a new downtown office at 17th and Wazee, and coworking giant recently opened two locations in Denver, one of which is downtown.

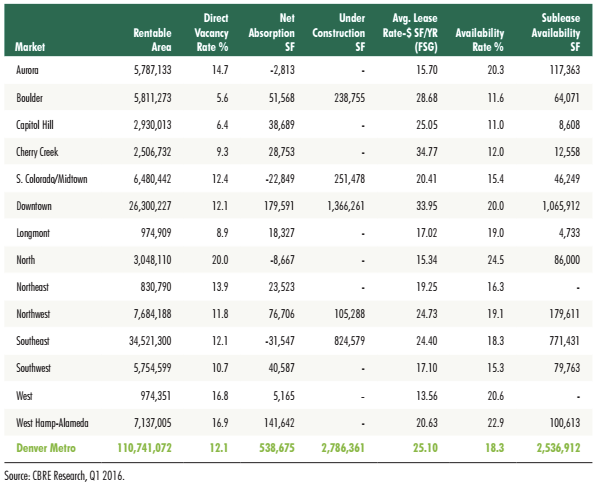

“The Denver and Boulder market continued to perform well in the first quarter of the year,” said Alex Hammerstein, Senior Vice President of CBRE Tech & Media Practice. “While Denver office vacancy hit a 15-year low and lease rates increased 6 percent year-over-year, we are seeing some signs of a maturing real estate cycle. Suburban office markets performed exceptionally well in the first quarter, which is also indicative of the maturing cycle. Almost 94 percent of office investment activity occurred in the suburbs, and Boulder experienced the greatest increases in office lease rates. While leasing activity may slow, the fundamentals point to continued health for the Denver and Boulder commercial real estate market in the quarters ahead.”

The quarter’s data did show an increase in sublease activity in downtown Denver but CBRE attributed that to the rise of oil and gas contraction. Despite the spike, the office market experienced its fourth consecutive quarter of positive net absorption, landing at 538,675 sq. ft.

While many experts hypothesized a slow start to 2016 for the real estate market, Denver has proven otherwise as 2016 appears to be headed on the right trajectory. With several new spaces opening up over the next few quarters, the city (and the state) can expect to see even more growth in the commercial real estate market.